As a staffing company, we often come across workers who are filing self-employed taxes for the first time. We get lots of questions on filing taxes as an independent contractor, so we’re breaking things down below to give you some clarity.

Let’s be clear, filing taxes can be overwhelming for anyone, so don’t feel alone in that anxious feeling of “I have no idea what I’m doing!” We know how difficult filing taxes can feel, but with this information, we hope to clear up some misconceptions and empower you to take action.

Let’s dive in…As an independent contractor (IC), the federal government views you as a self-employed individual.

This has the largest impact on how you will be taxed both on the money you’re collecting from working and how all of that is added up at the end of the year when you report your earnings.

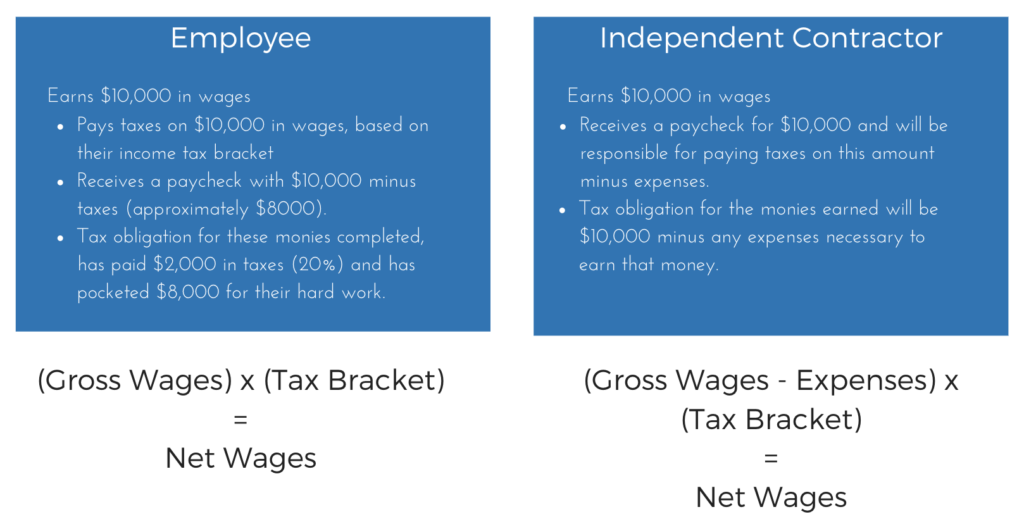

One of the primary differences you will notice is that a payment from IC work will have full wages, with no taxes taken out. This doesn’t mean you don’t have to pay taxes, it just means you will be taxed in a different way. When you’re an employee, they are “withheld” from your paycheck, when you’re self-employed, they’re owed at the end of the year, once you’ve deducted all your expenses. Basically, you get all your money upfront, get to live off of it, write off your costs, then pay taxes on what’s left at the end… pretty cool, huh?!

The way the organization you work with knows what to withhold (or not, in the case on independent contractor work) is based on the forms you fill out when onboarding with them. You’re probably used to completing a W4, where you elect your deductions. As a self-employed person, you will be submitting a W9 form for how you’d like to be taxed instead. At the end of the year, instead of a W2, you will receive a 1099. It’s all just a whole bunch of IRS mumbo-jumbo that simply means “I am a self-employed person.”

In the example below, we will demonstrate the difference between how an employee vs. an independent contractor gets taxed on their wages.

Now let’s move on to write-offs…

Items that are deemed as write-offs for independent contractors often overlap with what is ordinary and necessary to do a job anyways. For example, driving yourself to the location of work, wearing appropriate clothing for that work, providing supplies in order to do the work effectively, or managing your professional certifications in order to remain working.

All of what has just been mentioned are examples of write-offs for self-employed individuals. Below is a list of sample write-offs, this is not the entire list, just some ideas of what could be utilized to reduce your tax liability as a self-employed person.

- Mileage to & from the worksite reimbursed at the federal rate

- Cost of clothing (khakis, polo, shoes, jacket, etc) to conduct work in

- Cost of all supplies (including office supplies)

- Professional memberships or certification required to remain working

- Cost of professional liability insurance

- Cost of continuing education units to remain working

- Meals purchased while on the way to & from or while working

As you can see, these are typically expenses or fees we would otherwise have to pay simply to work as an athletic trainer, so there is the added benefit of being able to write off the full cost of these when working as an independent contractor. In the above example of earning $10,000 in wages, with the above write-offs, you could probably expense around $2,000 from that total. Leaving your tax obligation to be paid on $8,000, which at 20% is only $1600, effectively saving you $400 in taxes.

Remember, this is a gross overgeneralization and the reality of each person’s situation will be different so it is recommended that you work alongside a tax professional to determine the best fit for your needs.